Minimum Amount To File Taxes 2024

Minimum Amount To File Taxes 2024. If your gross income exceeds the required filing threshold, you must file taxes. The irs is currently planning for a threshold of $5,000 for tax year 2024 (the taxes you file in 2025) as part of the phase in to implement the lower over $600 threshold enacted.

What is the minimum income to file taxes? Taxpayers will file their 2024 taxes in early 2025.

As You Gather Your Financial Documents, Choose Your Prefer Select.

The 2023 standard deduction for tax returns filed in 2024 is $13,850 for single filers, $27,700 for joint filers or $20,800 for heads of household.

If You Have Net Earnings Of.

Citizens or permanent residents who work in the u.s.

The Irs Begins Accepting Tax Year 2023 Returns On Jan.

Images References :

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, The irs begins accepting tax year 2023 returns on jan. A dependent's income can be unearned when it comes from sources like dividends or interest payments.

Source: www.stepbystep.com

Source: www.stepbystep.com

How to Know the Minimum Amount to File Taxes, This amount is $13,850 in 2023 ($14,600 in 2024). The irs begins accepting tax year 2023 returns on jan.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

IRS Refund Schedule 2024 When To Expect Your Tax Refund, If you have net earnings of. If you are unable to file before that date, you still have options.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, If you’re under 65, you probably have to file a tax return in 2024 if your 2023 gross income was at least $13,850 as a. For tax year 2024, or the taxes you file in april 2025, these are the tax brackets and income thresholds for the various filing statuses:

Source: www.prefile2290.com

Source: www.prefile2290.com

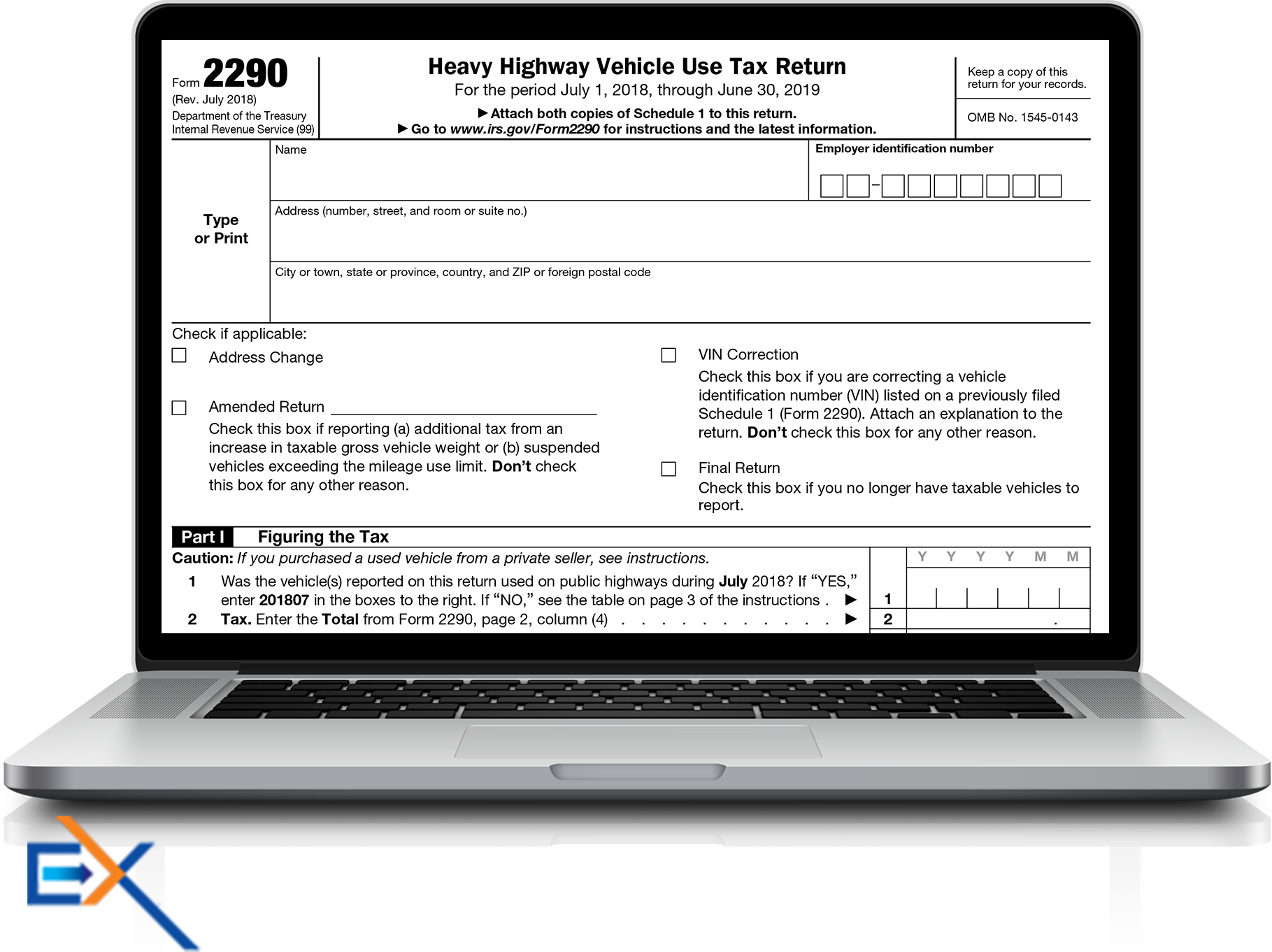

PreFile 2290 Form Online for 20232024 Tax Year & Pay HVUT Later, Generally, you need to file if: If you file on paper , you should receive your income tax package in the mail by this date.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, You can file for an extension. Minimum income requirements for filing a 2023 tax return.

Source: lennaqevelina.pages.dev

Source: lennaqevelina.pages.dev

Federal Standard Deduction 2024 Audrye Jacqueline, Citizens or permanent residents who work in the u.s. A dependent's income can be unearned when it comes from sources like dividends or interest payments.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, If you file on paper , you should receive your income tax package in the mail by this date. What is the minimum income to file taxes?

Source: www.thequint.com

Source: www.thequint.com

Tax Return for FY 202324 Last Date and Deadline; Easy and, Here’s a brief overview for the 2023 tax year, showcasing the minimum income required to file taxes based on your filing status and age: The agency expects more than 128 million returns to be filed before the official tax deadline on april 15, 2024.

Source: savingtoinvest.com

Source: savingtoinvest.com

2024 Tax Season Calendar For 2023 Filings and IRS Refund Schedule, Tax brackets the irs increased its tax brackets by about 5.4% for each type of tax filer for 2024, such as those filing. Your gross income is over the filing.

It Depends On Their Gross Income,.

The irs is currently planning for a threshold of $5,000 for tax year 2024 (the taxes you file in 2025) as part of the phase in to implement the lower over $600 threshold enacted.

Married Filing Jointly For 2024 Taxable Income Of.

In special situations, you may have to file regardless of your income.