File 2024 Income Tax Extension Online Free

File 2024 Income Tax Extension Online Free. If you file an extension (which you'll need to do by april 15), you'll have until tuesday, oct. You can file for an.

(joe raedle/getty images) millions of americans will participate in an annual. Request an extension by mail.

For Tax Year 2023 (Filed In 2024), You Needed To Submit Your Tax Extension Request By Monday, April 15—The Regular Tax Filing Deadline—Or Face A Penalty.

15, 2024 to file taxes.

According To The Kentucky Dor, If You Get A Federal Extension, You Automatically Have An Extension To File With Kentucky.

For the 2023 tax year, most taxpayers must pay by the original filing deadline of april 15, 2024—even if they file for an extension.

The Irs Also Levies A Fine If You Don't File Or Ask For An Extension By April 15.

Images References :

Source: www.expressextension.com

Source: www.expressextension.com

IRS Tax Extension Efile Federal Extension, The irs also levies a fine if you don't file or ask for an extension by april 15. Check if you're eligible to use direct file, the new free tax tool to file your federal taxes directly with the irs.

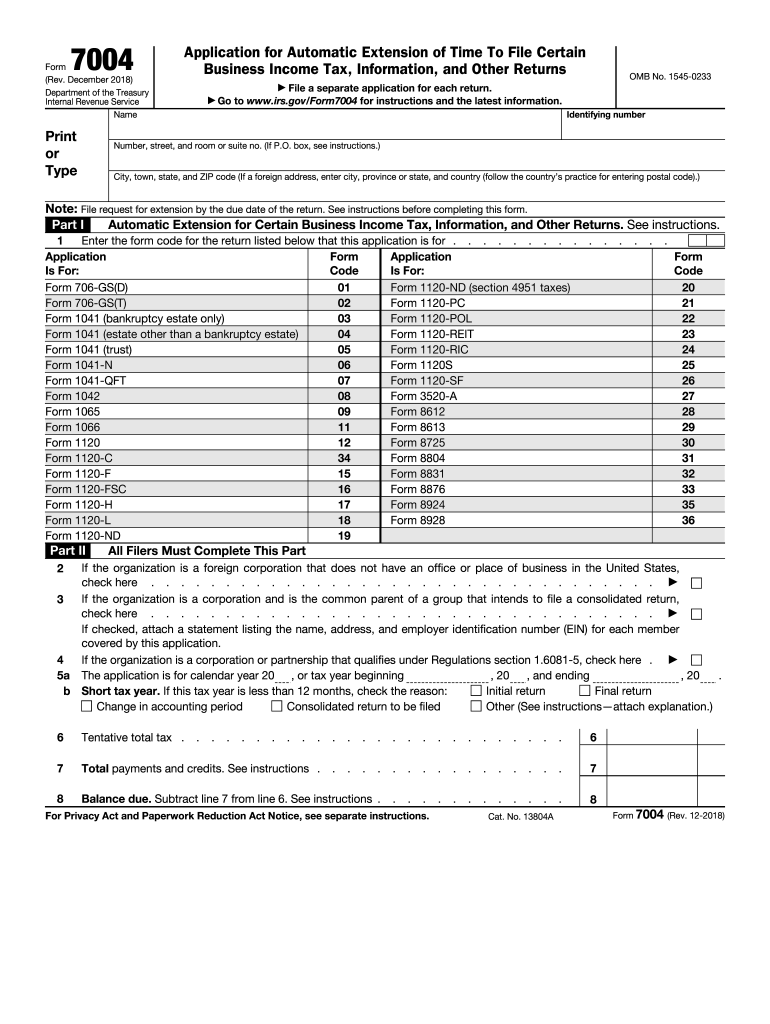

Source: www.dochub.com

Source: www.dochub.com

Irs application for extension Fill out & sign online DocHub, While you will get more time to file your return, an extension does not grant you more time to pay your taxes. Free federal tax extension is now available.

Source: www.fool.com

Source: www.fool.com

How to File a Business Tax Extension in 2024, Roughly 37% of taxpayers are eligible. Washington — the internal revenue service today announced that irs free file guided tax software service is ready for taxpayers to use.

Source: blanker.org

Source: blanker.org

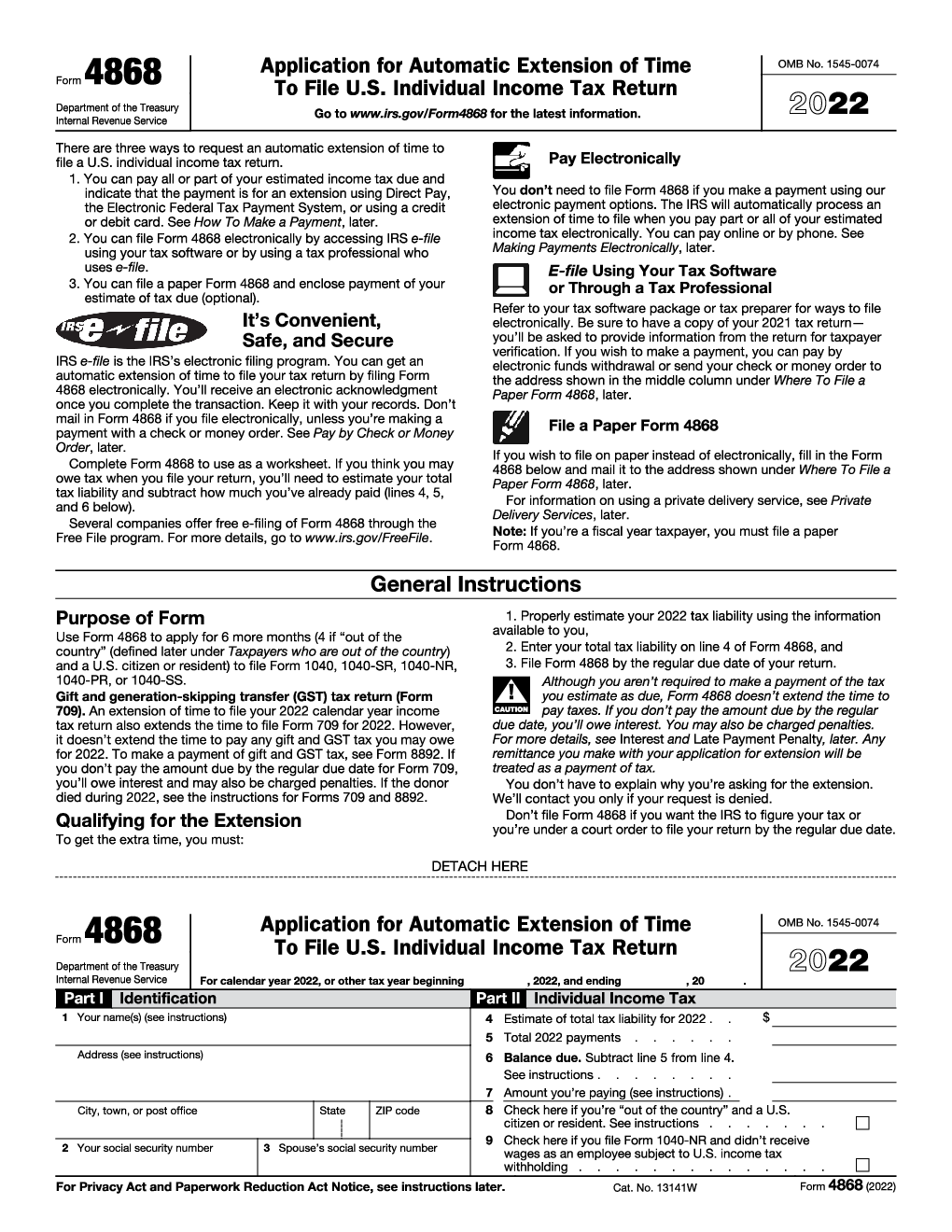

IRS Form 4868. Application for Automatic Extension of Time To File U.S, If you file an extension (which you'll need to do by april 15), you'll have until tuesday, oct. Fidel beltran stands in front of a liberty tax office in miami in 2019.

Source: onlinetaxhodenji.blogspot.com

Source: onlinetaxhodenji.blogspot.com

Online Tax Irs Online Tax Extension Form, Page last reviewed or updated: Roughly 37% of taxpayers are eligible.

Source: www.thequint.com

Source: www.thequint.com

Tax Return for FY 202324 Last Date and Deadline; Easy and, For the 2023 tax year, most taxpayers must pay by the original filing deadline of april 15, 2024—even if they file for an extension. Irs free file program delivered by 1040.com.

Source: printableformsfree.com

Source: printableformsfree.com

Federal Tax Extension Form Printable Printable Forms Free Online, 15, 2024 to file taxes. It has launched in california and 11 other.

Source: www.marca.com

Source: www.marca.com

IRS Form 4868 How to get a tax extension in 2022? Marca, If you have a form 1040 return and are claiming limited credits only, you can file for free yourself with turbotax free edition, or you can. Now, anyone who earned an adjusted gross income (agi) of $79,000 or less in 2023 can access guided tax prep that'll help them file their federal taxes online.

Source: teenaqwalliw.pages.dev

Source: teenaqwalliw.pages.dev

Tax Return Extension 2024 Shirl Marielle, “this can be a common mistake,”. Just be sure to attach the federal.

Source: gkeduinfo.blogspot.com

Source: gkeduinfo.blogspot.com

tax 2023 2024, Irs free file program delivered by 1040.com. Irs free file program delivered by fileyourtaxes.com.

Irs Free File Program Delivered By Fileyourtaxes.com.

For tax year 2023 (filed in 2024), you needed to submit your tax extension request by monday, april 15—the regular tax filing deadline—or face a penalty.

Just Be Sure To Attach The Federal.

In 2024, a tax extension that’s submitted by april 15 moves your filing deadline to oct.